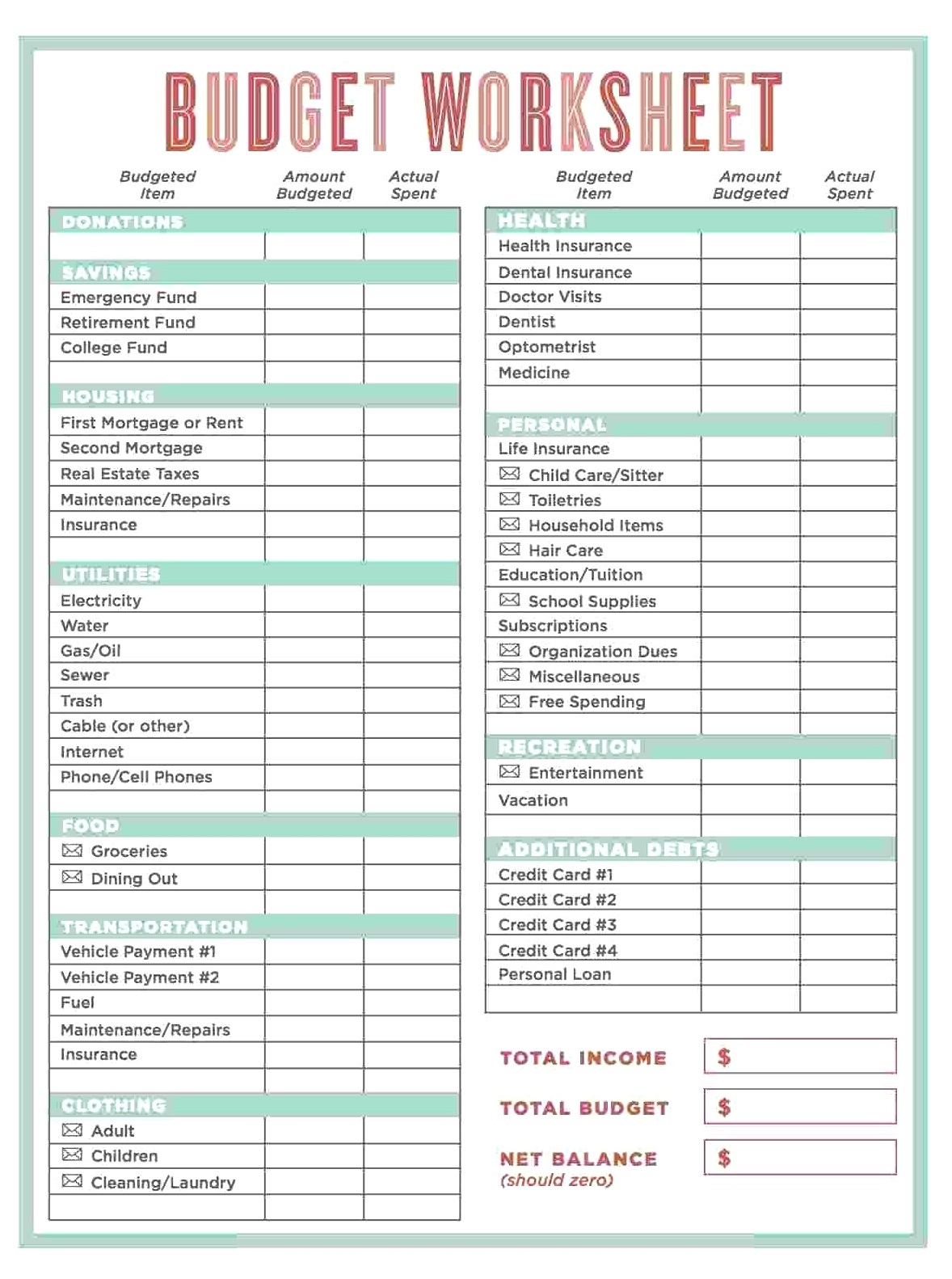

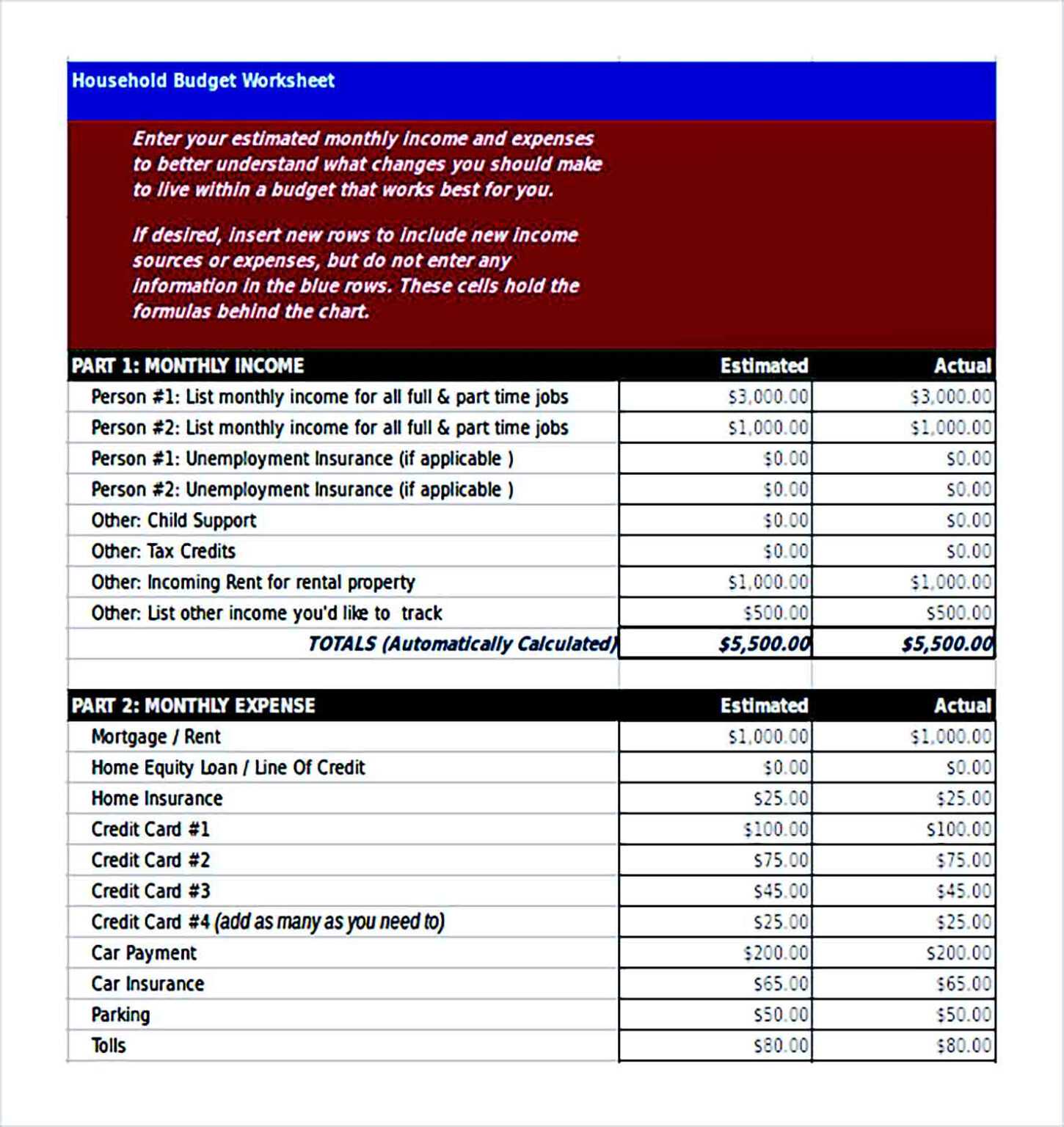

You can use these numbers as a rough guide for your own budget. Clothing and personal care products: 4.5 percent.Transportation, including vehicle costs and gasoline: 17 percent.Utilities and other household expenses: 13.7 percent.Rent or mortgage payments: 19.6 percent.While monthly expenses vary based on your income and where you live, the Bureau of Labor Statistics has found that the average household's expenses are: Once you have collected the necessary information, you can begin to "map out a budget based on reality," advises Stein-Smith. If your budget is tight and your rent payment goes out before your pay check is deposited, you may find yourself being charged an overdraft fee from your bank. In addition to the amounts going in and out of your bank account, Stein-Smith says it's important to look at the timing of your payments compared to your check deposits. Once you have accounted for your current income sources and expenses, Stein-Smith advises that you "figure out how your cash inflows compare to your cash outflows." Ideally, your income should be greater than your expenses to give you a little wiggle room for unexpected costs that arise from month to month. To help track your expenses, Quicken Starter Edition includes several categories, or you can create your own, such as: Discretionary expenses are those that fluctuate, such as grocery bills and entertainment expenses. Stein-Smith and many other financial experts agree that it helps to organize your expenses into two broad categories: Fixed expenses include rent or mortgage payments, car payments and any other expenses that are the same every month. Organize Fixed and Discretionary Expenses.Long-term goals might include buying a house or having a comfortable retirement. Medium goals include eliminating credit card debt or having enough saved to take a family vacation. The first step Stein-Smith suggests is to "make a plan for your short, medium and long-term goals." For example, short-term goals include ensuring that your expenses don't exceed your income or beginning a systematic savings plan. To help get you started, Sean Stein-Smith, a New Jersey-based CPA, CGMA and member of the AICPA’s National CPA Financial Literacy Commission, recommends a five-point plan for tracking your monthly expenses.

#SAMPLE PERSONAL BUDGET SOFTWARE#

Simply start by entering your monthly transactions - the software tracks your budget automatically. The budget tools in Quicken Starter Edition make creating a budget a breeze. By knowing exactly how much cash you have coming in, you can take control of your money and direct it to where you most need it. A monthly budget is a fundamental tool for understanding your household finances.

0 kommentar(er)

0 kommentar(er)